For the next couple month's I'm spending my Wednesday nights with my fellow civic nerds at the Ann Arbor Citizens Academy. While I'm at it, I figure I should do some homework of my own; here's some:

One of the most basic questions is: what is the City of Ann Arbor anyway? For me it also helps to work out everything that *isn't* part of the City.

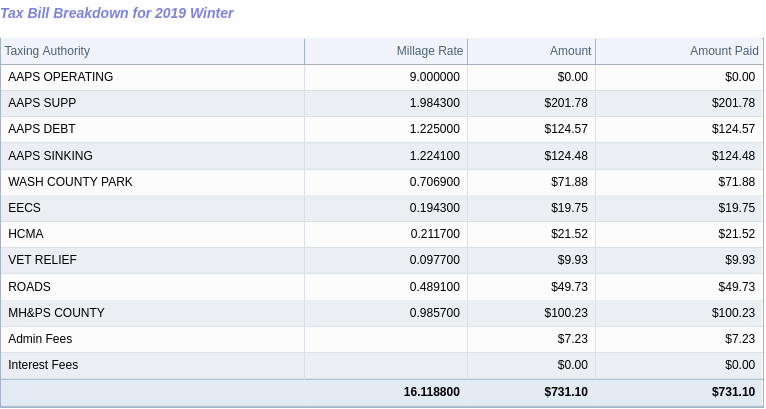

Local government is mostly funded by property taxes--so that's one great place to start. Look up a random address in this Ann Arbor property tax database, then check out the "tax information tab", and look at the most recent summer and winter taxes (they'll have different stuff on them). You'll see something like:

This example is from an owner-occupied home in Ann Arbor. The "millage rate" column adds up to about 67 mills, but note that there's a 9-mill "AAPS OPERATING" millage collected twice a year which such properties don't pay. So they're paying about 49 mills all together (about 49 thousandths of one-half the value of the house; more on that calculation another day!). Of that, about half is for education, mainly AAPS. AAPS is *not* part of the city--it has its own board and its own district boundaries, which extend outside Ann Arbor itself. School taxes are a whole complicated story themselves.

Then there's about 7 mills to Washtenaw County--"WASH COUNTY PARK", "EECS", "VET RELIEF", "ROADS" (which pays just for county roads), "MH&PS COUNTY", and "WASH COUNTY OPER".

HCMA is it's own thing.

So is the library--AADL is independent of the City and of AAPS (though it has the same geographical boundaries as AAPS).

That leaves about 16 mills--about a third--to the city, all on the summer bill. Those include separate millages for trash collection, streets, park maintenance, park acquisition (I believe that's the greenbelt millage), and the bus system--the AAATA is also part of the city.

Now this is just for one type of property. Also, Tax Increment Financing arrangements capture some property tax income but don't show up on tax bills at all as far as I can tell. So it would be more useful to know how the total property tax collected from Ann Arbor properties is distributed--for that, see this chart from the city's website. There you see that the city's portion of the total tax collected is about a quarter. And there are also a few other items there, including the DDA and Spark, which are also part of the City.

Also, of course, property taxes aren't the whole story--the water system, for example, is also the City's responsibility, but it's funded by fees. And not everything the city does is funded revenue earmarked for that purpose.

I'm still trying to figure all this out--more another day!

There's much more about the city's structure in Howard Lazarus's A2CA presentation, and more on city finances in Tom Crawford's A2CA presentation. See also links to all Ann Arbor Citizen's Academy Presentations.